What is a Home Warranty? Understanding How It Works (Example Included)

A home warranty could possibly cover repairs for home systems and appliances, but it's crucial to understand it's not the same as homeowners insurance.

While it may seem expensive upfront, a home warranty could possibly offer long-term savings by covering costs of repairs and replacements that homeowners insurance might not.

Home warranties can provide convenience by connecting homeowners with qualified technicians, managing the repair process, and potentially reducing out-of-pocket expenses.

Before deciding if a home warranty plan is right for you, it is important to know what a home warranty plan is.

Home warranty insurance is a service agreement between a homeowner and a company that states the company will cover the repair and maintenance costs of home systems and appliances for a given period. A home warranty is not home insurance. People sometimes confuse the terms home warranty (or home protection plan) and homeowners insurance, but they are very different products. If you are shopping for home protection, ensure you understand the definition of a home warranty before enrolling.

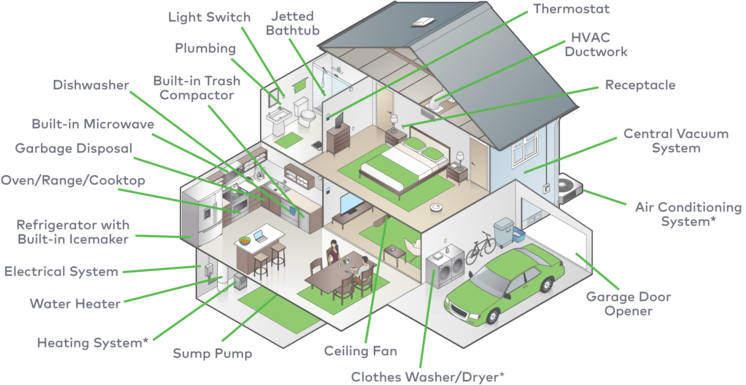

*Graphic showing what a home warranty might cover depending on the plan you get

Let’s take a deeper dive into this topic.

A home warranty typically covers major home and kitchen appliances like refrigerators, washing machines, clothes dryers, and dishwashers. They also cover electrical, plumbing, HVAC, gas lines, and more. Depending on the scope of your contract, home warranties can cover costs due to normal wear and tear and replacements in the event of breakdowns or malfunctioning systems. A home warranty does not cover structural elements of a home, such as doors or windows. They don’t cover stand-alone or smaller appliances like electrical fans or toaster ovens.

Purchasing a home warranty can seem costly at the outset, but it makes good financial sense in the long run. Home warranties can translate to significant savings on maintenance, repairs or replacement of appliances and systems that you would otherwise have to pay out of pocket. This is especially true for older appliances and systems or those in older homes. You’ll pay for a home warranty by paying a set monthly or yearly premium, but this cost means you have the security that your systems are covered, even in the case of major breakdowns.

Let’s look closer at the various aspects of home warranties and what they mean for you.

How do home warranties work?

A home warranty plan differs from a manufacturer’s warranty, which only covers service, repair, and sometimes replacement costs for a specific product or system. On the other hand, home warranty coverage can be tailored to cover multiple systems and appliances, irrespective of their particular brand or manufacturer. Moreover, they cover the cost of issues usually not included under home insurance plans.

To better understand what a home warranty plan is, let’s look at an example to understand how home warranty policies work in simple terms.

Home Warranty Use Example In Real Life

Imagine you buy and move into a brand new house. The location is great. The neighborhood is pleasant, and the view outside your window every morning is delightful. Everything seems to be in perfect working order — until you step into your second-floor bathroom for the first time, and nothing works. All the other bathrooms are fine, but this one doesn’t seem to have water coming through the bath, shower, or faucets.

If you don’t have a home warranty plan, you’ll have to locate and call a plumber to fix the problem. If the problem turns out to be minor, you're probably on the hook for a couple hundred dollars. If it ends up being major — for example, repairs require breaking into the bathroom floor to replace a broken pipe or fixture — you could be looking at a bill for several thousand, at least if you don’t have the right home warranty coverage.

Now imagine the same circumstances, except this time, a competitive home warranty service like Cinch Home Services covers your home. In this case, you’d need to contact Cinch customer care online and explain your problem. Cinch will have a qualified repair professional in your home in no time to diagnose the problem and give you an estimate of the time and money it will cost to set things right. Even if your problem turns out to be significant, with a home warranty plan in effect, you’ll probably pay a fraction of the cost you would have paid otherwise. Your only cost could be a small monthly fee or deductible. With a home warranty plan, it’s as simple as that.

What’s more impressive is that we offer a 180-day workmanship guarantee on all covered repairs. In other words, your peace of mind is guaranteed with a Cinch home warranty!

Pros and cons of home warranties

A home warranty is an easy way to ensure that important systems and appliances in your home are regularly maintained to operate in top-notch condition. Home warranties can help you avoid the hassle of caring for every bit of equipment yourself. With this kind of coverage, you won’t have to jump in whenever something goes wrong.

Advantages of having a home warranty

Savings

Let’s say your central air conditioner is 10 years old and breaks down suddenly in the middle of a hot summer day. You call in an HVAC professional hoping for a quick fix, only to learn that your air conditioner is beyond repair. Now for the terrible news: The average cost of replacing a central air conditioning unit comes to $5,860. If your existing ductwork needs upgrading, you’re looking at up to $3,600 on installation alone. The air conditioner is just one of many home systems that can face a breakdown.

With a home warranty plan in effect, you’ll pay a flat monthly plan premium and then a deductible when you place a claim. In other words, a home warranty, in the long run, can mean huge savings.

Convenience

Issues with home appliances and systems can be frustrating. Without a home warranty, you’ll have to hunt for a technician, usually after combing through never-ending user reviews online. You might think the worst part is over once you find a professional you’d like to work with. But that’s rarely the case. Most repair companies deal with many calls daily, which means there’s usually a significant wait time before someone arrives at your door.

On the other hand, if you have a reliable home warranty plan such as from Cinch*, you only need to call customer care or contact them online. If more than one appliance or home system breaks you can place multiple claims, and sometimes save by paying one deductible per service trade needed to handle your issues. It will schedule a skilled technician to show up at your home to attempt to fix your problems quickly. You pay your small deductible or service fee, and the warranty will take care of everything that's covered under your plan. If there are non-covered charges you will receive an estimate before the work starts. No negotiating or bargaining is required.

Peace of mind

This is perhaps the most significant advantage of home warranties. The savings, convenience, and overall dependability contribute to your peace of mind. There won’t be any surprises, shocking expenses, or waiting around to get things fixed!

However, some people have complaints, usually concerning the extent of their coverage. Let’s look at some of the top gripes with home warranties:

Surface or cosmetic issues

Accidentally dented your dishwasher front panel? Are you having difficulty ignoring the nicks and scratches on your refrigerator door? We wish these minor nags could be papered over and made perfect again! However, home warranties do not cover cosmetic issues like dings and scratches that don’t affect the operation of an appliance or system.

The stuff outside your home

You might have spent a pretty penny building a new patio by the garden or changing the shingles on your roof. But your home warranty doesn’t cover home repairs on these and other items outside the house.

No repairs needed

Another complaint many people have about home warranties is that sometimes you can find yourself paying for the service and not needing any repairs for the whole year. When this happens, a home warranty might seem like an unnecessary expenditure. However, home warranty coverage can save you money and stress when your appliances break down.

How much does a home warranty cost?

The price of a home warranty depends on several factors. The range of systems and appliances you want coverage for, the type of home you live in, and your location (state, city, or town) all matter. Prices differ according to geographical location mostly because of the variable cost of living standards and other local factors.

You can opt for home appliance coverage, home system coverage, or complete home warranty coverage that includes both. You might also have to pay extra for additional coverage over standard plan prices. Get a quote to understand the pricing details of each plan before signing up for a warranty.

There may be a waiting period after you’ve paid for a plan and before it becomes effective. That period typically ranges anywhere from 14 to 45 days.

Are home warranties worth it?

Unless you’re a skilled technician with years of experience working on a wide variety of home appliances and systems, the answer to whether home warranties are worth the cost is an unequivocal yes!

As we’ve already seen, paying out of pocket for every minor repair and service can add up to quite a sum over a year. Add to that the time and energy you’ll have to expend on every one of these incidents, and you’ll see that having blanket coverage on all essential appliances and home systems makes a lot of sense. Once you understand what a home warranty is, we’re sure you will see the necessity of having proper coverage.

When you look at the long-term impact of home warranties, it’s usually clear that they pay for themselves.

How do you choose the best home warranty for you

Now that we understand how important having a home warranty is for you and your family, let’s tackle the question of selecting the right home warranty provider. Here are the qualities you should look for:

- Clear contract: Choose a home warranty provider that offers a transparent contract with well-defined terms and conditions, clauses and exclusions. This will help ensure there are no surprises buried under the fine print.

- Market reputation: Research generously for user feedback, comments left on review platforms, and independent appraisals on home warranty reviews websites. Following this step will help you gain a fair assessment of the company’s reputation.

- Reach and network: Ideally, look for a company that operates across various states and territories. An established service provider with a presence across locations is likely to be more reliable while offering the best prices on your home warranty.

Cinch Home Services is a trusted partner that promises reliable service at budget-friendly prices. We offer an easy-to-understand home warranty contract with no fine print or hidden clauses. Signing up with Cinch offers you several unbeatable advantages:

- Availability: Cinch offers year-round, 24/7 service without weekend breaks or holidays. This means no waiting around for customer service to place a claim, whether day or night.

- Trust: All service partners in the Cinch network are vetted for your protection. We also ensure compliance with local licensing requirements.

- Quality: All work done under a Cinch plan comes with a 180-day workmanship guarantee without exceptions.

Home warranty FAQs

For those unacquainted with the finer details of a home warranty, several nagging questions might remain. Here are the answers to some of the most frequently asked questions:

What’s the difference between a home warranty and homeowners insurance?

A homeowners insurance policy is something you buy from an insurance company. Whereas a home warranty is a service contract by a warranty service provider.

Homeowners insurance covers the cost of losses arising from damage due to external forces like weather, fire, floods and earthquakes. It also covers damages caused by human factors like burglary, vandalism and arson. Your homeowners insurance will pay for repairs to the whole or a part of your home due to these factors, including costs related to replacing or rebuilding.

A home warranty, on the other hand, covers the cost of repair and replacement of major appliances and home systems like refrigerators, dishwashers, electrical systems, plumbing systems and so on. The precise coverage details in the case of both homeowners insurance and home warranty contracts depend on the type of plan and the extent of standard and optional coverage purchased by individual homeowners.

Do home warranties cover existing problems?

The short answer in most cases is no. However, service providers like Cinch will cover unknown pre-existing conditions that could not be detected with a visual inspection or mechanical testing at the time of purchase.

How long does a home warranty typically last?

Home warranty contracts typically last for one year. You can purchase a Cinch home warranty plan by paying fixed monthly payments or an annual lump sum.

Why so many people choose Cinch home warranties

Cinch is an award-winning home warranty service provider trusted by homeowners and home buyers across the U.S. Our reliable, fast and consistent service record is what sets us apart in the market. The Cinch advantages — such as our 180-day workmanship guarantee — are part of our commitment to provide homeowners with unbeatable service and lasting peace of mind. That's why we've serviced over four million claims over the last six years.

So, get ready to forget hefty repair or replacement bills when you sign up for a Cinch Home Services warranty. Our plans provide you with comprehensive coverage of major home appliances and built-in home systems. Or you can choose our home protection plan that gives you complete coverage of all vital assets in your home. Sign up for the Cinch experience by getting an instant quote today.

* Subject to plan terms and conditions.

*The information in this blog library is intended to provide general guidance on home warranties, and on the proper maintenance and care of systems and appliances in the home. Not all of the topics mentioned are covered by our home warranty or maintenance plans. Please review your home warranty contract carefully to understand your coverage.

*Our blog library may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links.

What is a home warranty? In this article, we break down how home warranties work, what's covered, and if it's right for you.